Understanding the Theory of Change for Impact Investing

Impact investing has emerged as a significant movement within the financial sector, aiming to generate positive social and environmental outcomes alongside financial returns. At the core of effective impact investing lies the Theory of Change (ToC), a strategic framework that guides investors in understanding how their investments can lead to desired outcomes. This article explores the concept of the Theory of Change, its importance in impact investing, and how it helps in creating measurable and meaningful impact.

What is the Theory of Change?

The Theory of Change is a comprehensive explanation of how and why a desired change is expected to happen in a particular context. It outlines the pathways from the current situation to the desired outcome, identifying the necessary interventions and conditions that must be in place. This framework helps stakeholders, including investors, nonprofits, and social enterprises, to map out their vision and understand the steps needed to achieve it.

In the context of impact investing, the Theory of Change provides a roadmap for how investments will contribute to specific social or environmental goals. It involves identifying the long-term goals, working backwards to identify the preconditions necessary to achieve these goals, and then developing a set of activities that can bring about these preconditions.

Components of a Theory of Change

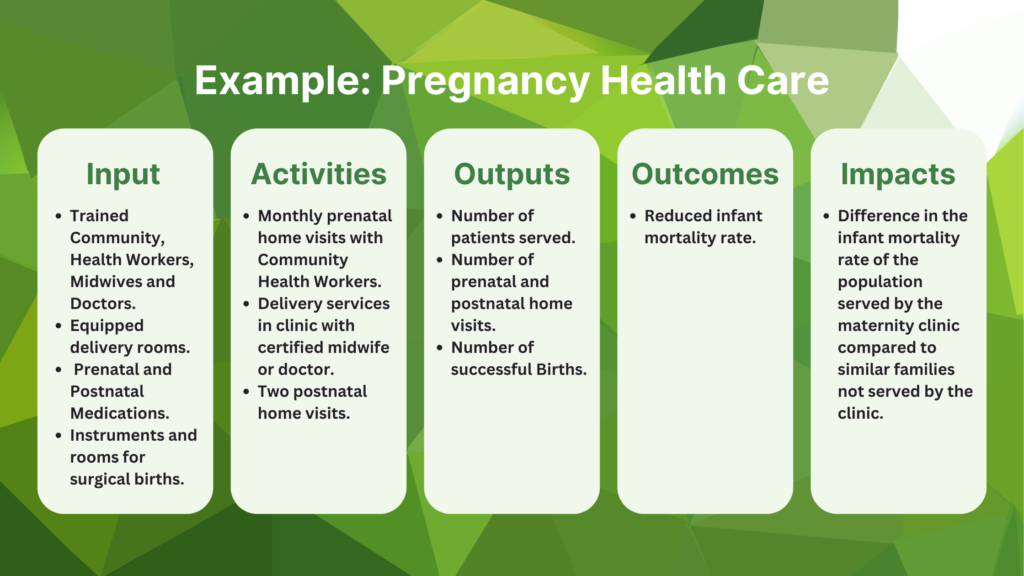

A Theory of Change is built upon several key components that outline the pathway from investment to impact. Understanding these components is crucial for impact investors, as they provide a structured way to plan, implement, and evaluate their investments. By breaking down the process into manageable elements, investors can better navigate the complexities of creating positive social and environmental outcomes. Let’s explore each component in detail:

Inputs: These are the resources invested in the project in service of a set of activities, including financial capital, human, physical or intellectual resources and technical expertise. In impact investing, inputs often include the capital provided by investors to fund projects or enterprises.

Activities: The specific actions taken to bring about change in support of business and impact objectives. These activities can range from providing education and training to developing new technologies or building infrastructure.

Outputs: The immediate practices, products and services resulted from the activities, which are tangible and measurable. Outputs might include the number of people trained, products developed, or services delivered.

Outcomes: The changes/effects on individuals or the environment that result from the outputs that follow from the delivery of practices, products and services, which can be short-term, medium-term, or long-term. Outcomes focus on the changes in behavior, knowledge, or conditions that occur as a result of the activities.

Impact: The broader, long-term changes/effects of the outcomes that can be attributed to the activities undertaken. Impact is often aligned with overarching social or environmental goals, such as reducing poverty, improving health outcomes, or mitigating climate change.

It is important to also consider assumptions and risks about how change will happen and the potential challenges that might arise. Identifying assumptions and risks is crucial for understanding the conditions that could affect the success of the investment.

Why is the Theory of Change Important in Impact Investing?

The Theory of Change is crucial in impact investing for several reasons. First, it provides strategic clarity by offering a clear and detailed pathway to achieving desired outcomes. This clarity helps impact investors select investments that align with their values and mission, ensuring that all stakeholders share a common understanding of the goals and strategies. Second, a well-defined Theory of Change includes specific indicators for measuring success, enabling investors to track progress and assess the effectiveness of their investments. This fosters accountability by setting clear expectations for what the investment aims to achieve. Third, the Theory of Change is a dynamic tool that can evolve as new information becomes available, allowing investors to learn from their experiences and adapt their strategies to better achieve their goals. Finally, the Theory of Change serves as a communication tool that helps investors articulate their goals and strategies to a broader audience, including potential investors, partners, beneficiaries, and the public. A well-articulated Theory of Change can build trust and credibility, attracting more support for the cause.

Challenges and Considerations

While the Theory of Change is a powerful tool, it is not without challenges. One key challenge is the complexity of measuring impact, particularly in the long term. It can be difficult to attribute changes directly to specific investments, especially when multiple factors influence outcomes. Additionally, developing a Theory of Change requires careful consideration of the context and the unique needs of the target population.

Moreover, there is a risk of oversimplification. While it is important to have a clear pathway to impact, real-world change is often nonlinear and influenced by various unpredictable factors. Therefore, investors must remain flexible and open to adapting their strategies as needed.

Conclusion

The Theory of Change is a foundational element in the field of impact investing, providing a structured approach to understanding how investments can lead to meaningful social and environmental outcomes. By offering strategic clarity, facilitating measurement and accountability, and supporting learning and adaptation, the Theory of Change helps impact investors maximize their positive contributions to society. As the field of impact investing continues to grow, the Theory of Change will remain a crucial tool for ensuring that investments are not only financially successful but also truly transformative.